Perspective

I often encounter good people struggling in their jobs to fulfill their most basic responsibilities. This might be closing a deal to up or cross sell to an existing customer, booking an order, fulfilling customer orders, providing basic customer support, and billing.

These professionals, expecting these to be established or easily matured capabilities, instead often find themselves working long nights, over weekends and way too hard with their red, glazed over eyes serving as testament to their protracted efforts and the high costs these have exacted on their health and their lives. They get worn down maintaining a hurdler’s pace, they don’t get to the work they actually want to be doing to grow the company, and eventually their commitment at any cost to deliver reaches a breaking point.

My empirical (non-scientific) experience suggests this scenario is not unusual. I would argue that it is more the norm. And it is all avoidable. But before we address how, let’s examine why this might be happening at all.

What are the underlying causes of this phenomenon? Change, of course. The times are changing across the board – despite any organizational strategy or perspective, we are all at the mercy of megatrends. For example, here is a mashup of some you have heard of

-

Technology such as the Internet of Things (IoT), virtual reality, AI, robotics continues to challenge age-old precepts underpinning business models and enable new ones for those who have the creativity and lack of vestment in the status quo to pursue them. We are still early into the most recent industrial revolution and have seen whole industries disappear, combine into new ones, and new ones emerge – in a short span of time.

-

Demographically, the world is changing fundamentally. Urbanization is increasing worldwide and at an accelerated pace. People are living longer and having fewer children – especially in the America, Europe and east Asia. European and Russian populations are not only not expanding as quickly, they are shrinking, while expansion by birth slows in North America. African populations are exploding as with many equatorial nations, producing a massive and young market for goods and services.

-

Globalization inflated the scope of measure for all businesses from millions to billions and trillions, forcing recalculations of risk-return for business managers, and increasing the complexity of their landscape.

-

Multi-language, multi-culture, geographic diversity collectively is revealing new opportunities as much as new types of challenges to contend with as managers seek to enter new markets and extend and evolve existing ones. National barriers to trade adjust in response to opportunity, equity and labor shift to where they can be best served and consequently, power centers are shifting worldwide too.

The urgency that today’s business managers are responding to results from this context of confluent conditions. It is this urgency of uncertainty that is driving the need to show progress more frequently to increasingly anxious shareholders.

Managers who value the priorities of their shareholders will respond appropriately as the rational course of action. And as managers shift the operational locus of organizations in a bias to action, organizational appetites for long-term investment diminish or disappear completely. Every existing industry is affected. And by all counts, managers are behaving rightly and rationally on behalf of their shareholders.

And I would argue that this is as incomplete an understanding of stakeholder intent as it is prevalent. There is more to this story.

Continuous delivery is a strategy for sales and market growth; it is not a sustainable strategy for continuous revenue growth. Good business developers can build a book of business for any product or service when they know their customer’s industry as well as or better than their customer do. And without the continuous investment in a company’s capabilities to fulfill those order, the floor will eventually fall out from underneath the operation.

Not only will revenue be lost as customers refuse to pay, terminate their agreements and tell ‘everybody’ about their bad experiences, new customer pipelines will dry up quickly. Customer Retention Costs (CRC) will increase as attention is diverted from running the business to making good on existing commitments, building new business will be challenged further increasing Customer Acquisition Costs (CAC) and growing Customer Lifetime Value (CLV) – the key ingredient in propelling shareholder value beyond the event horizon – will move further and further out of reach. How does this serve shareholder interest? It doesn’t.

So back to the point and the pain I see and hear about from my network almost daily….

A shared view of the business, the market, the product or the customer is often elusive without a natural business imperative to forge one. Each department sees a different view of the business, has their own language for interacting with it, and their own priorities – as they should. Each has its own constructs centered around their respective charters and only notionally awareness of the impacts of exchanging with other. This manifests operationally as incongruous data quality from one hand off to another. As such, people are distracted from doing their core job because they are busy reconciling misunderstandings from bad information.

Bad data quality is evidence of under-investment in process. And it is the source of under-performance and under delivery and revenue leakage in organizations that do not focus on the long-term.

A lack of process definition or misalignment of process to tools and operational requirements present hurdles that any dedicated employee will race to overcome to deliver for their management. And their well-intentioned creativity – enlisting additional colleagues in solving for their challenges, building manual tools and unofficial channels for getting the focus they need to solve their up and downstream problems – undermine the ability of the enterprise to achieve a sustainable momentum that a scalable business needs to hit its revenue targets.

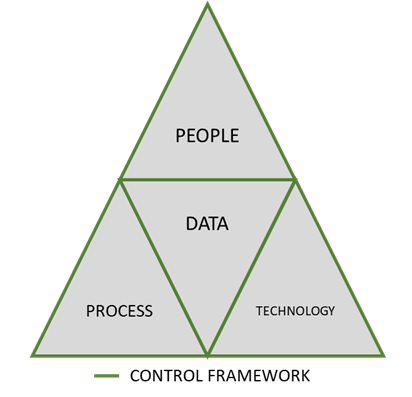

A cohesive framework of operational controls is essential to ensure business rules and processes are known and adhered to in the course of business as usual. Too often they are imposed after the fact in response to some incident or scare, rather than contemplated and implemented as a strategic differentiator for a business. Control frameworks are meant to ensure that the business is protected from itself as it takes risks (like adapting to megatrends) and performs its basic functions in a dynamic and chaotic world as it scales. Among the administrative, physical and technical controls, technology is the one that has huge promise to not only protect process enforcement, but to new capabilities with consistency and speed of execution.

Technology investment, therefore, gets most of management’s attention, though typically without the governance and direction of the business stakeholders who are directly affected by it – they just don’t have the time.

Good engineers can make almost anything happen – I believe this – A-N-Y-T-H-I-N-G. But what should they be doing? Given the crush of urgency in today’s environment, business stakeholders do not make defining their needs in the language engineers want to hear it as a priority. It is hard to do, frankly, even with time and good resources. And people under duress gravitate to what they are comfortable doing when given a choice – getting their job done. As a result, technology investments are often misaligned to the processes that they are intended to enable, and ROIs are unrealized.

Bringing it all together in summation,

-

people do whatever it takes to get the job done

-

in the absence of clear direction, rules get bypassed and processes break down when they do not provide clear advantages to people doing their jobs

-

when technology is misaligned to process intent, it causes data incongruities that disrupt basic business processes and require frequent redress, a drain on the organization

-

control frameworks are an afterthought, as they are not seen as a contributor to revenue growth, creating additional risks that go unattended further eroding the operational foundations for sustainability

-

as a result, data quality suffers, undermining the entire enterprise.

I used to think this was hyperbolic. I have not for many years now. Witnessing the opportunity costs of ignoring this simple though esoteric correlation materialize is as damaging to my financial prospects as it is heart breaking.

I used to think this was hyperbolic. I have not for many years now. Witnessing the opportunity costs of ignoring this simple though esoteric correlation materialize is as damaging to my financial prospects as it is heart breaking.

Data is not a by-product of your business. Data is your business.

Your product and its value proposition is described using it, as are the deals you close and book and bill in your financial systems – as well as the terms of your compensation for selling it. Your customer relationships, your ability to know who they are and what they are entitled to and whether or not you are delivery to their expectations are expressed in it. Your people use it, they have processes that make it easier or harder to manage it, using tools that are aligned or not to collect, store, transform and present it. Your controls make sure everything stays together or are inadequately deployed and fail to do so.

So firms need to invest in process to have a firm foundation for continuous growth. It seems so obvious; perhaps that is why it is under appreciated and not given the attention it warrants.

Bad data undermines your peoples’ best efforts to delivery. Bad data directly increases the costs of goods sold (COGS). Good financial stewardship of any venture that has ambitions of succeeding and thriving in today’s and tomorrow’s world must give data quality its rightful place in the enterprise.

Data is a corporate asset. It is not a bi-product; stop treating it as one. Or lose to those who know better.

A few reputable sources that influenced this stream of consciousness:

The Predictive Power of Demography, Geopolitical Futures

EYQ Megatrends

Megatrends: 5 global shifts changing the way we live and do business

The Challenger Sale: Taking Control of the Customer Conversation